|

|

|

|

|

|

|

|

|

|

| |

Trump

Economy:

Six

Months

In -

Boom or

Bust?

Mixed

signals

emerge

as

President

weighs

trade

wars

against

strong

fundamentals

Li Haung

-

National-Politics

Tell Us

USA News

Network

WASHINGTON

- Six

months

into

President

Donald

Trump's

second

term,

the

American

economy

presents

a tale

of two

narratives:

robust

growth

metrics

that the

White

House

touts as

validation

of

"America

First"

policies,

alongside

mounting

concerns

from

economists

about

the

long-term

sustainability

of the

current

trajectory.

The

Numbers

Tell a

Strong

Story

The

latest

GDP

figures

released

this

week

showed

the

economy

expanded

at a

3.0%

rate in

the

second

quarter,

exceeding

expectations

and

reversing

a modest

decline

from the

previous

quarter.

The

unemployment

rate

remains

historically

low at

just

over 4

percent,

with

671,000

payroll

jobs

created

during

the

first

five

months

of the

administration.

Core

inflation

has

tracked

at just

2.1% —

levels

not seen

since

the

first

Trump

Administration

— and

right in

line

with the

Federal

Reserve's

inflation

target.

The

White

House

has

seized

on these

figures

as

evidence

that

Trump's

economic

agenda

is

delivering

results.

"The

data

speaks

for

itself,"

Treasury

Counselor

Joseph

Lavorgna

declared,

calling

the GDP

report

"an

absolute

blockbuster."

Tariff

Tensions

Create

Headwinds

Yet

beneath

the

positive

headline

numbers,

warning

signs

are

flashing.

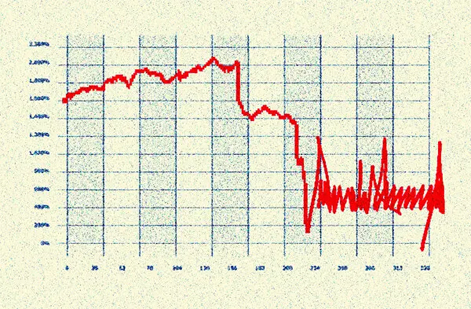

Trump

faced a

financial

market

backlash

when he

imposed

sweeping,

double-digit

tariffs

on

nearly

every

country

in the

world,

with

major

stock

markets

plummeting

and bond

markets

flashing

warning

signs.

The

damage

to the

global

economy

from

American

protectionism

is

becoming

increasingly

evident,

with US

protectionism

slowing

investment

and

rewiring

supply

chains

at the

expense

of the

global

economy.

Analysts

at

Morgan

Stanley

said

"the

most

likely

outcome

is slow

growth

and firm

inflation,"

though

they

stopped

short of

predicting

a

recession.

The

European

Union

and

Japan

have

begun

accepting

Trump's

15%

tariff

regime,

representing

what

some

economists

see as a

concerning

shift

toward

global

trade

fragmentation.

The

Inflation

Wildcard

One of

the

biggest

questions

facing

the

Trump

economy

involves

the

Federal

Reserve's

monetary

policy.

Trump

continues

to

pressure

Fed

Chair

Jerome

Powell

for

substantial

rate

cuts,

though

many

economists

warn

such

cuts

could

risk an

inflationary

spike.

Despite

tariff

fluctuations,

inflation

has

remained

relatively

mild,

rising

just 2.4

percent

in May —

the

lowest

since

2021.

However,

economists

worry

that

continued

trade

tensions

combined

with

aggressive

monetary

easing

could

reignite

price

pressures.

Looking

Ahead:

Sustainable

Growth

or Sugar

High?

The

Trump

administration

is

betting

heavily

on its

"One,

Big,

Beautiful

Bill" —

a

comprehensive

tax and

regulatory

package

that the

Council

of

Economic

Advisors

projects

could

increase

GDP by

up to

5.2

percent

in the

short-term

and up

to 3.5

percent

in the

long-run.

Critics

argue

that the

current

growth

may

represent

a

temporary

sugar

high

rather

than

sustainable

expansion.

While

Trump

appears

to be

getting

his way

with the

world

economy,

with

trading

partners

accepting

higher

costs

through

tariffs,

the

question

remains

whether

this

approach

can

maintain

momentum

without

triggering

broader

economic

disruption.

As one

economist

put it:

"I'm

pretty

bullish

right

now on

the

economy,"

reflecting

the

cautious

optimism

many

feel

despite

underlying

concerns.

The

coming

months

will

likely

determine

whether

Trump's

second-term

economic

experiment

represents

a

sustainable

boom or

sets the

stage

for

future

economic

volatility.

For now,

the

fundamentals

remain

strong,

but the

structural

changes

to

global

trade

relationships

introduced

by this

administration

continue

to

create

uncertainty

about

the path

ahead.

This

story is

developing

as

economic

data

continues

to

emerge

throughout

the

week.

|

|

|

|

|

|

|

|

|